We’ve got all your financial bases covered with a full suite of banking solutions and financial tools to help you succeed. And we offer the personal service and expertise you’ll only find at a community bank.

That’s not just a tagline, it’s our mission. And it’s why we’ve been invested in our customers and our communities for 147 years.

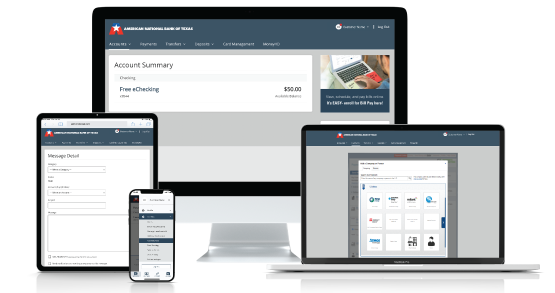

A Community Bank In A Digital World®

With our online and mobile banking, you’re always connected. Bank at any time, in any place, and in any space. Or if you need in-person help, find a friendly face at your neighborhood ANBTX banking center.

ANBTX was named as one of the best financial institutions in the state in 2020. Something only 2.8 percent of all banks—and only five in the state of Texas—can claim. But what's even better? The recognition comes directly from our customers.

Get to Know Us